Investing in private credit just got more lucrative. Here’s why

Recent regulatory guidance is spurring a seismic shift in debt markets. For investors, there’s never been a better time to get involved in private credit.

Banks were recently warned to tread lightly with venture lending. The directive was sent from the Office of the Comptroller of the Currency (OCC), a US Treasury bureau responsible for safeguarding the banking system.

The Q4 2023 OCC directive (discussed below) will cause banks to tighten their lending standards to venture-backed firms. Technology firms in particular will be hard-hit. Set against a backdrop of higher-for-longer rates and weakening tech valuations, this guidance will only add to the funding woes of tech firms.

Importantly, it will also spur companies to look outside of traditional debt and equity markets for growth funding.

For investors, the opportunity is ripe. Here’s everything you need to know about investing in private credit in 2024.

2024 will be the year of private credit — here’s why investors should take note

Private credit is poised for a flood of interest from high-quality companies looking for funding. Previously, these firms would have sought either cheaper bank credit or venture capital. Today, neither of those options are attractive, tipping the balance in favor of private credit.

Well-informed investors stand to benefit. And it’s debt investors who are poised for the greatest opportunity. Private credit investors can expect to earn consistent, high yields from the funding of stable growth companies — as long as they know where to look.

In 2024, expect to see the following:

More funding deals going to the private credit market

Fewer companies raising equity rounds

Banks tightening lending standards to venture-backed firms

High-quality companies willing to accept higher interest rate debt

Companies increasingly willing to seek out alternative funding sources

More lucrative terms for private credit providers and their investors

Firms turning to private credit to fund growth investments, working capital, acquisitions and more

There’s been momentum behind private credit since Dodd-Frank pushed more deals out of the banking system and into private credit markets. This OCC directive is a continuation of this decade-plus-long shift, and it’s sparking a flurry of private credit dealmaking.

Today, private credit investors are experiencing multiple tailwinds. Keep reading to learn the backdrop, the recent OCC memo catalyst, and the outlook for investors in 2024.

The backdrop: Rough fundraising conditions for rising tech companies

Even before this recent regulatory guidance, tech firms were already facing significant funding challenges:

Rising interest rates since early 2022 have increased borrowing costs dramatically

Falling valuations have increased the dilutive cost of equity rounds

Tightening lending standards have made funding more difficult

Weakening public market sentiment has made venture funding harder to come by

The collapse of Silicon Valley Bank encouraged banks to further tighten lending standards

Fed signals of “higher for longer” rates further reduced investor appetite for growth firms

This is a relatively recent shift, to be sure. Throughout the COVID-19 era, tech firms enjoyed near-zero rates and sky-high valuations. Researchers called the tech sector the “systemic beneficiary of the pandemic”. And it showed in just about every metric, from public and private valuations to global venture dollar volume.

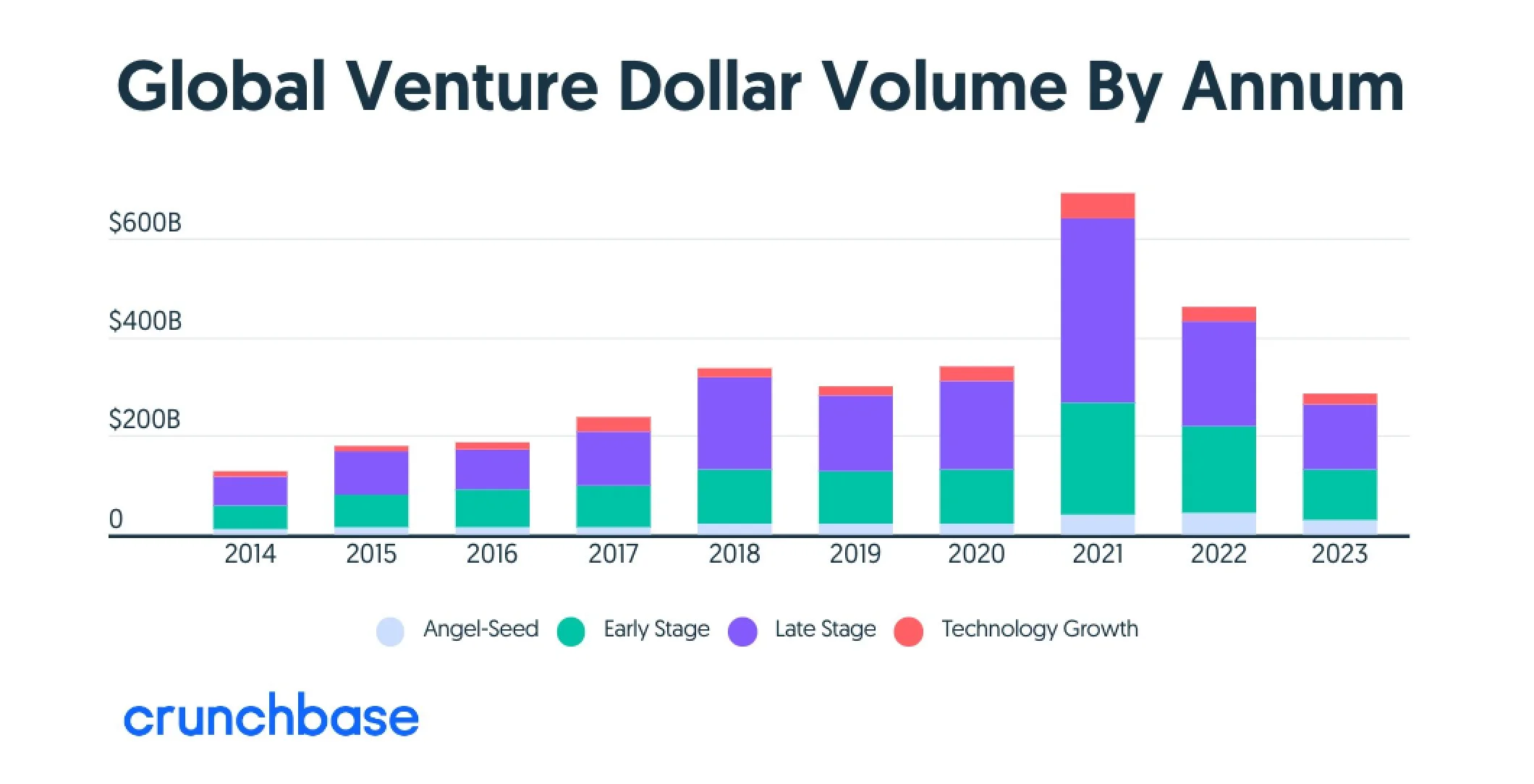

In 2021, startup funding peaked at an all-time-high, with $694.1 billion of venture funding flowing into startups. Much of this went to the tech sector. Tech firms had absolutely no problem raising funds — even those with questionable burn rates and unsustainable models.

That era has come to an end.

Total global startup funding in 2023 clocked in at the lowest level in 5 years — down a full 38% from 2022, and 59% off 2021’s funding buffet.

It’s not just funding. A flurry of high-profile bankruptcies hit the tech sector in late 2023 — Plastiq, WeWork, and Bird, just to name a few. From a NYT/PitchBook analysis, more than 3,200 venture-backed companies went out of business in 2023 in the U.S. alone. While some of this is a natural culling of the herd, some of these bankruptcies were caused by a lack of access to capital.

With equity investors typically being low on the capital priority stack, many venture firms and investors have been burned. VCs are understandably spooked. And the Silicon Valley Bank (SVB) collapse certainly didn’t help. The Fed’s recent guidance has spurred public markets to a rally, but has done little to influence investor appetite in private tech firms.

All this adds up to a definitively unpleasant funding environment for startups and growth-stage tech firms. It couldn’t possibly get much worse, could it?

The catalyst: Fewer, more costly bank loans moving forward

The Office of the Comptroller of the Currency (OCC) isn’t usually known for crushing dreams.

And yet, a November 2023 OCC memo put up a brick wall in front of the last remaining (relatively) inexpensive funding source for growth-stage firms: Bank loans.

The OCC is a bureau of the U.S. Treasury, and it’s specifically tasked with safeguarding the banking system. In response to what the OCC views as a threat to the stability of the financial system, the bureau issued guidance essentially warning banks to tread lightly with venture loans.

The guidance applies to all national banks and Federal Savings Associations. It relates specifically to commercial lending to what the OCC calls “high-risk, generally venture-backed companies”. While it doesn’t prohibit these types of loans, the bulletin highlights the importance of stress-testing, liquidity risk management, and well-defined underwriting rules for any banks engaging in venture lending.

Interestingly, the OCC’s definition of “high-risk” borrowers is exceptionally broad.

The bulletin calls out lending activities to “high-risk borrowers in an early-, expansion-, or late-stage of corporate development.” Early- and expansion-stage firms are familiar with increased scrutiny when applying for loans, particularly in a high rate environment. But the focus on well-established firms is rare.

From the bulletin: “But late-stage companies continue to warrant strong underwriting analysis and monitoring because cash flow may be negative, intermittent, or insufficient to service debt, resulting in dependence on secondary sources of repayment. Secondary sources of repayment for late-stage companies can vary and may include private equity financing, public debt or equity, the sale of assets, or liquidity from earlier fundraising.” (emphasis ours)

The OCC is warning that, partly because of the difficulty of raising funds currently, lending to even late-stage companies carries additional risks for banks (and the banking system). At the same time, the OCC’s guidance itself will further tighten lending standards.

We discussed the implications of the OCC guidance in-depth here, but here’s an overview of what the guidance means for growing firms seeking funding:

Commercial banks will tighten their lending standards to a wide variety of companies

Even if loans are approved, they’re likely to be more expensive as they were prior to this bulletin (irrespective of the shifting rate environment)

Banks will continue to provide treasury management services to startups, but are less likely to offer a “one stop shop” with loans as well — prompting firms to look elsewhere

Banks that smelled opportunity in venture funding after the SVB collapse will be less likely to enter the space

Banks will also tighten standards when funding buy-outs and major acquisitions. This will have ripple effects downstream, further straining equity rounds and even inter-company acquisitions. In short:

Banks are likely to lend on lower leverage multiples, requiring larger buy-ins from equity investors

This will reduce leveraged IRR for investors, reducing appetite for acquisitions and major tech deals

This situation will put pressure on equity valuations, further increasing the dilutive cost of equity for firms

Overall, the OCC guidance is bad news for a huge number of firms seeking funding. Does anyone stand to benefit?

The opportunity: High quality companies hungry for private credit

The outcome of all this is that thousands of high-quality, stable companies are left with fewer options for funding.

Increasingly, they’re turning to private debt markets. Given the borrowing environment, they’re more than willing to pay a premium for non-dilutive funding.

For investors, this shift presents one of the biggest opportunities of the decade. As funding from commercial banks dries up, there are more high-quality companies chasing fewer lender dollars — leading to higher yields and greater opportunity for private investors.

It’s a bit of a perfect storm for growing companies, and an exceptional opportunity for debt investors. Better yet, funding private debt deals is not taking advantage of these companies — far from it. It’s simply providing what they need, at a price point that’s still far more attractive than alternatives.

At Coho Growth, we’re bridging the gap between private investors and high-quality, stable growth tech companies. Coho Growth funds businesses with a fully developed commercial product that are seeking growth debt.

Specifically, we invest $1-10MM in software companies with $2-20MM in annual recurring revenue. These are high-quality, vetted firms that have a proven product market fit, and simply need cash to fund growth.

These are also firms that just a year ago likely would have taken a bank loan or raised equity to fill their funding needs. In this environment, the cost of both equity and bank credit (if available) has skyrocketed — so much so that private debt is more attractive than ever before.

Connecting with Coho Growth can help you tap into this opportunity to fund high-quality, sustainable growth companies — and earn stable, high yields in the process.

But aren’t these companies “high risk”?

The OCC memo identifies “high-risk” companies that banks should take care when lending to (sparking this rush into private debt markets). So… are these companies actually risky?

The firms Coho Growth provides funding to are in a specific stage of sustainable growth that we have identified as an attractive balance of risk and reward. We’ve selected firms that have lower risk profiles, but are still passed over by the traditional banking system. We don’t make equity style investments - we look for companies that have been working on their growth plan – they have proof it's working – and they want to continue down that path without giving up equity or control.

Additionally, we are funding loan facilities, not equity rounds. In liquidations of U.S. companies, creditors have seniority over equity investors.

Software debt vs. tech equity investing: Considerations for 2024

We’ve explained the opportunity for debt investors already. But why not just invest in tech equities? Why join Coho Growth’s growth debt fund over a tech equity fund?

The last decade has been a hayday for tech equity investors — but that era seems to be over. Public markets peaked in late 2021. And while household name tech firms have more than recovered after December’s rate cut rally, the majority of tech valuations have yet to bounce back. If the era of cheap money is dead, they are unlikely to recover any time soon.

There are absolutely still attractive opportunities to be had in equity markets, both public and private. But for most, private debt strikes a very attractive balance of risk and reward.

Investing in private growth debt provides investors with:

High, consistent yields

Sustainable monthly distributions of income

Additional capital distributions, when received

Liquidation preference over equity investors in the case of bankruptcy

Access to high-quality companies that prior to this OCC guidance would have been serviced by commercial banks

To be clear, there have always been good opportunities in the funding of private credit. The industry has flourished since the post-2008 regulatory environment pushed more startup funding deals from banks into the private credit market. But in 2024, the opportunity is stronger than ever. Higher-quality, stable firms are increasingly seeking private credit, and willing to pay rates that were unheard of just a few years ago.

Coho Growth is poised to benefit. Are you?

Coho Growth: Your partner in private credit excellence

Coho Growth is a limited partnership serving growth-stage software companies. We offer attractive financing options, targeting established firms with $2-$20MM ARR.

The Coho Growth team has a 7-year track record delivering strong returns on $200MM of loans to 70+ companies. With the coming flood of high-quality tech firms seeking funding, we’re accepting investor applications to expand the fund.

Contact us today to tap into this exceptional opportunity.

Rob McFarland

Contributing Guest Author